“it’s unlikely that any on-road vehicles will feature “fully autonomous” drive technology in the short term (for instance, by 2020–22)”

–McKinsey, June 2015

Possibly jealousy of its eye-watering fees, I enjoy seeing McKinsey proved wrong. All of punditry has been caught off-guard by the neck-snapping acceleration of autonomous vehicle (AV) adoption.

Uber made the headlines last year when it unleashed a fleet of self-driving taxis in Pittsburgh. The Regulatory Capital of America, the State of California, approved true driverless AVs in April, joining a number of other states, all eager to become the center of a new industry. While Uber’s expansion has been stalled by a fatal accident in Tempe, Arizona, the level of investment in AVs across a number of firms is very significant. The apparent industry leader, Google-spinout Waymo, reports 7 million miles of impressive performance. The question is no longer “if autonomous vehicles?” but “when?”

How will AVs change the labor market?

Uber’s trial suggests that the first occupation at risk could be the nation’s 181,000 taxi drivers. Uber and Lyft have shown that this is a sector ripe for disruption. Already under siege by your cousin Amanda and her Honda Civic, taxi drivers must now fear cars with no driver at all. Relative to the size of the nation’s labor force, the loss of 181,000 taxi jobs isn’t much of a threat. Nor are these high paying jobs, averaging only $26,000 annually. Total earnings are nearly $5 billion, however.

If Uber’s taxis can safely navigate busy city streets, its newly-acquired Otto division hopes to take on the highway freight business. Trucks haul 70% of America’s freight, over 9 billion tons each year. IHS Global Insight and the American Trucking Association forecast growth of nearly 30% by 2026. And they predict that the number of trucks will grow from 3.6 million today to about 4 million.

But there aren’t enough drivers. One reason could be rules that limit the number of hours a driver can be on the road. A trucker can drive no more than 11 hours in 14, which must be followed by a rest period of at least 10 hours. Within any 8 day period, drivers are limited to 70 hours. These rules help keep the road safe but can leave a rig worth $200,000 idling for 122 hours in that 8 day period.

Enter autonomous trucks. Except for loading and unloading, truckers spend most of their time driving at a steady speed for hours on end. The greatest risk to trucking, truckers and those of us who share the road with them is fatigue. Otto’s sleepless technology is already being tested.

Thus the jobs of 1.7 million heavy and tractor-trailer truck drivers are also at risk. With average earnings of $42,000, their annual payroll is over $70 billion. Once the technology is proven & legal, the return on investment for trucks will be irresistible.

As Otto points out, computer-driven trucks are also likely to be a safer way to ship freight. The federal Department of Transportation’s Fatality Analysis Reporting System reports 3,660 fatal deaths in accidents involving big trucks in 2014. No surprise—68% of the people who died were in cars, not the truck. It will be hard to oppose cheaper AND safer.

As Otto points out, computer-driven trucks are also likely to be a safer way to ship freight. The federal Department of Transportation’s Fatality Analysis Reporting System reports 3,660 fatal deaths in accidents involving big trucks in 2014. No surprise—68% of the people who died were in cars, not the truck. It will be hard to oppose cheaper AND safer.

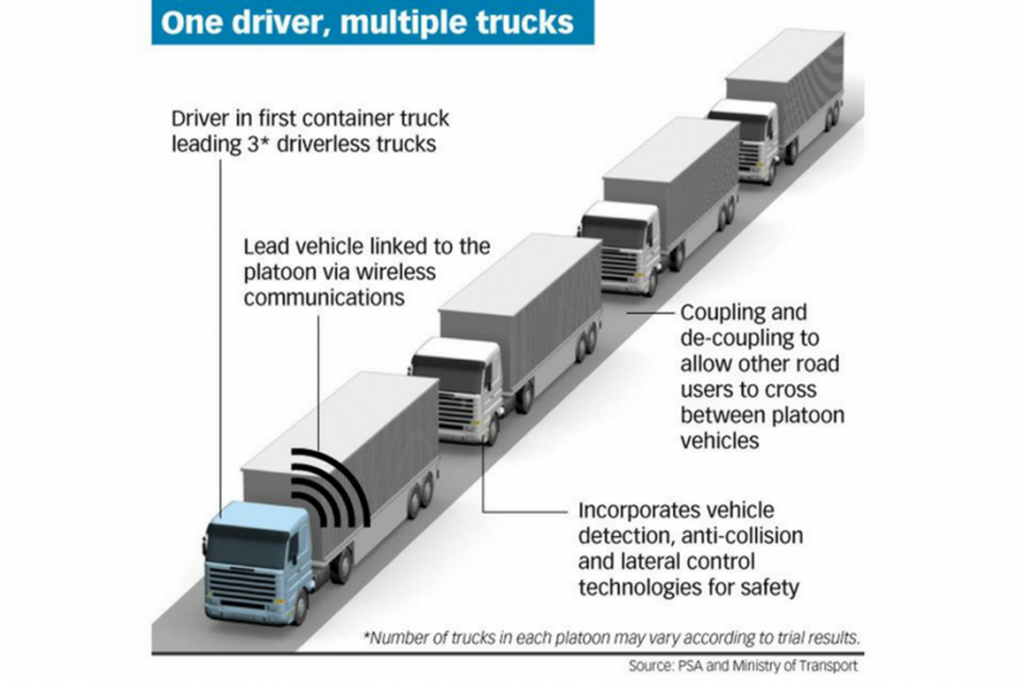

The first step for the automation of 18 wheelers will probably be the adoption of “platooning,” where several trucks travel together with a safety driver in the lead vehicle. If you have experienced “adapted cruise control” (a feature on my 2017 Toyota Prius), you’ll agree that this approach is already technically within reach. Truck “platoons” could manage the long haul portion of a freight trip, with human drivers navigating the final leg, just as locally-based marine pilots bring ocean tankers into port. Trials are beginning in Singapore.

Does everyone need a car?

The Census Bureau tells us that the average American household owns two cars. In a world of AV-fueled ride sharing, this will become an anomaly.

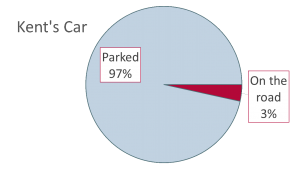

My office is 6 miles from my home, a 20 minute drive. Over a 5 day workweek, that totals 60 miles and 3 1/3 hours per week. Suppose I double my daily driving on weekends that adds another 48 miles and 2 hours and 40 minutes. Do the math: My car sits idle for 97% of the year (more, actually, as I bike to work about half the time when the weather is tolerable).

Even people who commute an hour to work each day leave their cars to age in place for more than 8,000 hours each year. Were autonomous taxis cheap and reliable, would we own our own cars? Count me out. At the very least, we would be a one car family, not two

There are nearly 1 million jobs in motor vehicle & parts manufacturing in the United States. Two million more work for motor vehicle and parts dealers. These jobs will not disappear but there will be far fewer of them.

AVs will change the shape of cities

When cars can park themselves (or we share vehicles far more than we do now), the need for convenient parking goes away. A search of PLUTO—New York City’s online land use database—shows that 8 million square feet in Manhattan is devoted to parking. Instead of parking near the office, Manhattanites will say, “Thanks, Jeeves! Go hang out in Jersey City or the Bronx until I call.” When we break the connection between the driver and “his” or “her” car, the parking business will be transformed.

When cars can park themselves (or we share vehicles far more than we do now), the need for convenient parking goes away. A search of PLUTO—New York City’s online land use database—shows that 8 million square feet in Manhattan is devoted to parking. Instead of parking near the office, Manhattanites will say, “Thanks, Jeeves! Go hang out in Jersey City or the Bronx until I call.” When we break the connection between the driver and “his” or “her” car, the parking business will be transformed.

Where developable land is most precious, land now in parking will be released for more valuable uses. Converting Manhattan parking to commercial use could add a half a billion dollars to New York’s property tax take, for example.

What about Rochester?

Retail competition between city and suburb has long been influenced by access to parking. Suburban shopping malls are surrounded by acres of asphalt or serviced by multi-layer ramps built on cheap land. When walkable parking no longer matters, might urban retail be revived?

Housing, too, is influenced by access to parking. Developers seeking to developed downtown housing will no longer need to put access to parking at the top of the list.

Even housing design will change. Many recent housing developments turn the “attached garage” concept on its head. What will we do with our two car garage when we no longer own even one?

Even housing design will change. Many recent housing developments turn the “attached garage” concept on its head. What will we do with our two car garage when we no longer own even one?

And what about parking revenue? The Rochester airport booked $8 million in parking revenue in 2017. The Niagara Frontier Transportation Authority, which runs Buffalo’s airport, earned nearly $18 million.

Even the proposed downtown performing arts center has a stake in the parking business. The pro forma released by the Rochester Broadway Theatre League includes $300,000 in annual parking revenue.

A brave new world?

The questions are endless: Will AVs exacerbate urban sprawl? How will AVs influence the competition among big cities, mid-sized cities and rural areas? Will the cost advantage of rapid transit trains and buses disappear if the largest single cost—the driver—is no longer needed? Might traffic congestion actually get worse?

Talk about a disruptive technology! And the revolution has already begun.