Our nation’s fiscal house is held together with duct tape and Crazy Glue. The porch roof is teetering—left unrepaired, it may collapse onto our economy at the end of the year. And our home’s foundation has a crack in it. While this structural gap between revenue and spending—largely caused by Baby Boom retirements—won’t be dramatically worse next year, the crack will get larger and larger until we make major repairs.

Our nation’s fiscal house is held together with duct tape and Crazy Glue. The porch roof is teetering—left unrepaired, it may collapse onto our economy at the end of the year. And our home’s foundation has a crack in it. While this structural gap between revenue and spending—largely caused by Baby Boom retirements—won’t be dramatically worse next year, the crack will get larger and larger until we make major repairs.

Taxmaggedon

A wide array of tax cuts are due to expire at the end of 2012. As the Bush White House couldn’t muster the 60 votes required for a permanent tax change, the 2001 tax cuts were passed using the Senate’s arcane “reconciliation” procedure, which forced a 10 year “sunset” provision. (The vote was 50-50 with Vice President Dick Cheney casting the tie-breaker.) Unable to reach consensus on much of anything in 2010, the President & Congress kicked the can down the road another 2 years. In February, the 2 percentage point reduction in the payroll tax rate originally passed in 2010 was extended to the end of the year.

So, what happens if Congress & the President don’t do a deal?

- Currently, the payroll tax funding Medicare and Social Security is 4.2% on individuals (plus an additional 6.2% on employers). It will go back up to 6.2%, a tax increase of $1,000 on a single earning $50,000 or $1,700 for a family earning $85,000. The cost of keeping this in place would be nearly $100 billion.

- Federal income tax changes

- The lowest income tax bracket—10%—disappears. The lowest bracket goes back up to 15%. The remaining brackets—25/28/33/35%—revert to 28/31/36/39.6%. Both our single earning $50,000 and our family earning $85,000 move from the 25% bracket to the 28% bracket. Using the standard deduction, I estimate that the $50,000-earning single filer pays an extra $700 and the married-filing-joint with $85,000 in earnings pays an extra $900+.

- Tax rates on capital gains were cut across the board—if our moderate income taxpayers receive any capital gain income, the rate rises from 15% to 20%.

- The Alternative Minimum Tax would again bite middle income taxpayers.

- The price tag for avoiding these changes is about $220 billion. The bill for the average middle income family is estimated to be about $2,000.

- Other provisions due to expire include a fix to the “marriage penalty” for joint filers, extension of unemployment benefits, provisions of the Child Tax and Earned Income Tax credits, a range of incentives for small business, alternative energy credits, and dramatic changes to the Estate Tax.

Sequestration

Facing an impasse over an expansion of the debt ceiling, the President & Congress approved the Budget Control Act of 2011, assembling a set of budget cuts so distasteful to both major parties (what they’re calling “sequestration”) that they would have little choice but to come to agreement on a more palatable alternative (or so we thought). Left unchanged, the law’s formula cuts $55 billion each from defense and nondefense spending in 2013. A formula-based cut in Medicare physician reimbursements is also pending. If Congress doesn’t act to change the law (as it has in the past), Medicare will spend $10 billion less in 2013, too.

Going Over the Cliff?

Although economists disagree mightily about many things, most concur that the combination of abrupt tax increases and a reduction in federal spending will threaten our lackluster economic recovery. The story might be different if the global economy were in better shape. Struggling to manage the sovereign debt of Greece, Spain, Italy and others, the Eurozone’s economy is weak. China’s growth rate is expected to fall below 8% for the first time in more than a decade. Global growth forecasts are being revised downward nearly across the board.

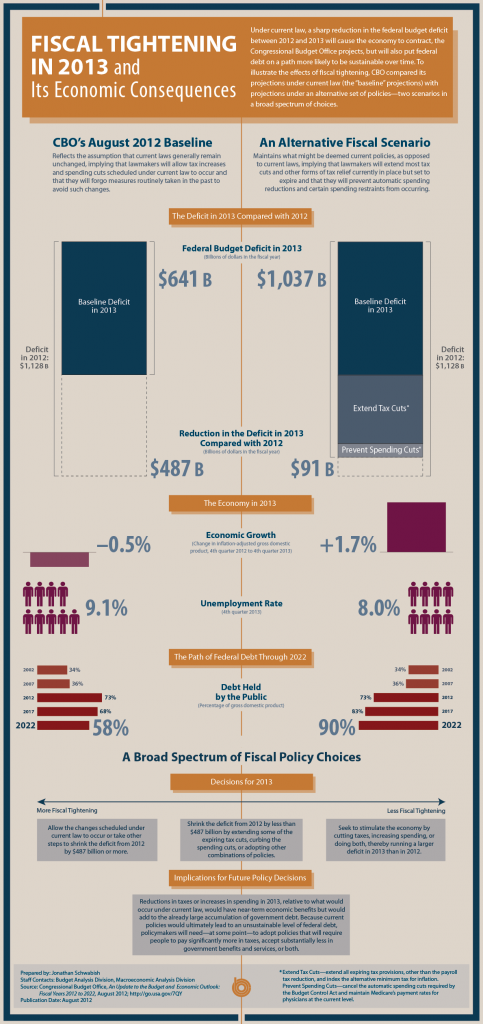

The Congressional Budget Office recently released its prediction of the consequences of leaving intact these pending changes in spending and tax law. Growth in real GDP—expected to end 2012 up 2.1%—would go into reverse, falling 0.5% in 2013. Unemployment, still stubbornly stuck around 8%, would rise to 9.1%. The good news is that the deficit will be cut nearly in half, from almost $1.2 trillion to a “mere” $600 billion.

The CBO also modeled an “alternative” scenario in which the more dramatic of the changes in spending and taxation—except for the payroll tax reduction—are deferred or cancelled. Under this scenario, the CBO’s models predict that recovery continues with real GDP rising 1.7% and the unemployment rate remaining at 8% (break out the bubbly!).

Fixing the Foundation

While a merry leap off the fiscal cliff seems unwise, our long term problems are serious. Social Security is a problem for two reasons: First, back when Baby Boomers were all working, Social Security ran a surplus. While we pretended to put the money into a “trust fund,” that didn’t mean what you might think—in fact, we borrowed the cash back to finance the national debt. Now that the surplus has evaporated, we have to finance the national debt from other sources.

Second, even when we acknowledge that this is a “pay as you go” program, we are entering a period in which the payroll taxes paid by working Americans won’t cover the cost of benefits, much less subsidize the national debt. The ratio of workers to retired recipients falls from 4.6 to 1 today to 2.7 to 1 in a generation.

Medicare is even more worrisome. Not only do we face the same demographic time bomb, but health care costs are likely to continue to rise rapidly as all of the factors driving health care cost inflation—new technology, greater life expectancy, etc.—have their way with Medicare.

Who’d Want That Job?

So we know that the near term is perilous—if we cut spending or raise taxes now, we endanger the recovery—but we must do both in the future. In the heat of the election we see little but division. We can hope that the leaders we elect in November will work together on lasting solutions, and will avoid the temptation to kick the can down the road for the next four years.

Alas, half solutions and temporary measures seem likely. At least duct tape now comes in different colors. You want red or blue?