Last Christmas my father-in-law asked for investment advice. Folks he’d been reading were recommending gold. “Gold?” I responded. “No, I’d definitely stick with the stock market. Gold is up 30% since the start of 2010—hard to believe it’s going to keep rising. Corporations are profitable. And they’ve got cash. Besides, Congress just passed that payroll tax cut. I’m not placing any bets on 2012 or 2013, but 2011 should be a decent year.”

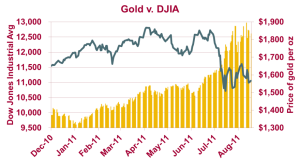

Good thing I’m spending THIS Christmas with MY family. If you’ve been hiding under a rock, the stock market hasn’t had a good couple of months (although prices were stable or rising until May)—As I write this, the Dow Jones Industrial Average is down 4% since Christmas. And gold? Up 34%.

Good thing I’m spending THIS Christmas with MY family. If you’ve been hiding under a rock, the stock market hasn’t had a good couple of months (although prices were stable or rising until May)—As I write this, the Dow Jones Industrial Average is down 4% since Christmas. And gold? Up 34%.

Growth in employment—already anemic—ground to a halt in August. GDP growth for the second quarter was first estimated at 1.3%, which was mildly depressing this long into a “recovery.” Then it was revised down to 1.0%. Although few indicators have slipped into reverse, none have shifted out of first gear and many, like employment, are slowing, not accelerating.

I should have warned my father-in-law that I’m a lousy forecaster. And I’m not about to try again. What I do know for sure is that the economy is vulnerable. That was true at Christmas, incidentally. And a vulnerable economy was subjected to a number of shocks, e.g. rotten weather, a rolling fiscal disaster in Europe, Hatfield & McCoy feuding in Congress, etc.

Enter Barack Obama’s American Jobs Act. He’s in a tough spot. Nearly every economist in the world agrees that the fiscal soup that caused the financial crisis had been simmering for years—and that recovery would be a long time coming. While I disagree with a number of steps taken by the President, I doubt that any post-crisis action on the part of the federal government could have spurred a robust recovery.

So let’s look at his plan, starting with the payroll tax reduction. This is in two pieces—one for employers and one for employees. The employer portion we could do without. Corporations are not delaying hiring because they can’t afford to. Collectively, they’ve a lot of cash. And if they need more, borrowing is cheap. No—they aren’t hiring because they don’t see consumers lining up to buy more stuff.

The same principle applies to the idea of bribing firms to hire the long-term unemployed. Remember, companies aren’t broke and they can borrow cheaply. Coming off a recession, no company will hire someone they don’t really need. The $4,000 bonus will push a few companies over the line, of course. Other companies will claim the money for hiring they intended to do anyway. And the bonus might persuade a few companies to hire Mr. A who is “long-term unemployed” over Ms. B who isn’t. But the choice of Mr. A over Ms. B will have to be a genuine toss-up. The cost of a hiring mistake will exceed $4,000 in a heartbeat. This part of the plan won’t do much harm, but won’t do much good, either.

On the other hand, cutting the employee portion of the payroll tax was a good idea in 2010 (and would have been a good idea in 2008). Naysayers point out that prudent consumers won’t spend more, just save more, making the policy ineffective. Yet even if the tax cut isn’t spent but saved, it will improve the consumer’s “balance sheet” and hasten the day when the consumer is ready to spend again. High debt is one of the causes of our current malaise. The problem for Obama is that the program may not help until after the election, but that simply makes it ineffective politics, not bad policy.

I can certainly support more spending on infrastructure, provided we focus on improvements we’ll have to do anyway.  The temptation, of course, is to build something completely new, which may or may not be needed. When we repair bridges or resurface highways, elected officials miss out on photogenic ribbon cuttings.

The temptation, of course, is to build something completely new, which may or may not be needed. When we repair bridges or resurface highways, elected officials miss out on photogenic ribbon cuttings.

But shouldn’t we worry about policies that increase the federal debt? I’m just as concerned as the next guy about our federal debt. But now isn’t the time to cut it.

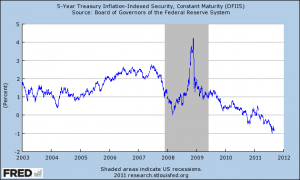

Karl Smith, an economist at the University of North Carolina at Chapel Hill, points out that the U.S. government is currently able to borrow for free. It reflects the weakness of the world economy—and the fact that confidence in the U.S. economy remains strong (relative to the rest of the world), regardless of what S&P has to say about the matter. Smith’s argument is more sophisticated than this—see his blog at www.modeledbehavior.com. He argues that the federal government could temporarily stop collecting taxes altogether, run the government on borrowed money and earn money on the “spread” when it is paid back. If the Treasury can borrow at, say 0.5%, and we’re confident that inflation will be at least 1%, then the taxpayer will be made better off by borrowing.

So do I support Obama’s plan or not? My word limit doesn’t allow me to opine on the rest of the plan, but I do think that the fragility of the economy and of our collective psyche (which matters) justifies action. I don’t have confidence that any federal action will turn around the employment situation quickly—sorry, Mr. President—but the ridiculously low cost of federal borrowing suggests that we should do what we can to put more money in the hands of consumers.

ORIGINALLY published in Rochester Business Journal 9/16/11