For most of 2009, Rochester ranked in the Top 20 in the Brookings Institution’s regular reports on the impact of the recession. Indeed, for 2009, Rochester had the 15th best job report among the nation’s 100 largest metros. New York’s job creation record was the best of the 15 largest states.

By the end of last year, Rochester had slid to #41 and New York State to #11. What happened? Well, not much. In Rochester, at least. Our job performance over the last decade has been quite consistent from year to year: We lost jobs, but never more than 2% in a year. The Great Recession was triggered when the real estate bubble burst, the construction and real estate sectors suddenly cooled and millions found their jobs gone or at risk. Having missed the boom, Rochester also missed the bust and continued the trend of the early part of the century—slow shrinkage as the economy struggled to absorb cuts at Kodak and other large employers.

One lesson people learned from the Great Recession is that the construction sector can’t get out ahead of the rest of the economy.  Not permanently, at least. We build things for a reason—houses for residents, office buildings for workers, and shopping centers for shoppers. With a weak job market, no warm & sunny winters to dangle before retirees, and a stagnant population, a Rochester construction boom never happened.

Not permanently, at least. We build things for a reason—houses for residents, office buildings for workers, and shopping centers for shoppers. With a weak job market, no warm & sunny winters to dangle before retirees, and a stagnant population, a Rochester construction boom never happened.

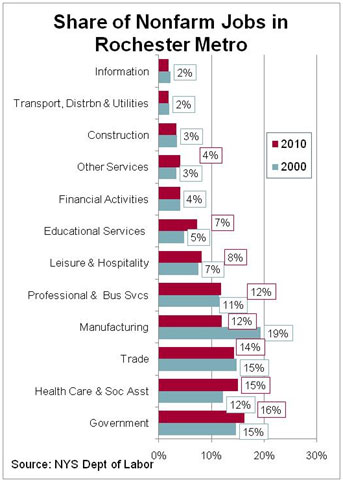

Our weak hiring picture is partly due to the decline in the region’s powerhouse manufacturing sector in general and Eastman Kodak in particular. Manufacturing was responsible for 19% of direct employment in 2000. Spillover employment—jobs in other sectors that serve only local residents and are fueled by those manufacturing salaries—was easily equal to that total. Manufacturing was effectively responsible for nearly half of the economy. By 2010 manufacturing employed only 12% of workers directly, a figure much closer to the national average of 9%. The rest of the economy has grown – but not enough to offset the 43,000 jobs lost in manufacturing.

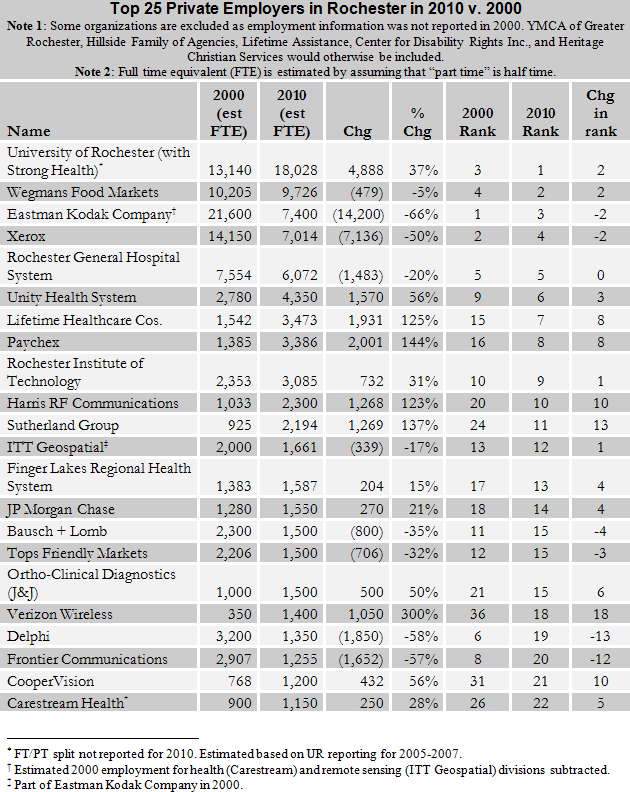

Kodak employment began its steady job decline after reaching a peak in 1982. Although film sales grew through the beginning of the 21st century, Kodak faced increasing competition and responded by improving productivity and outsourcing non-core activities. Only when film sales began to decline rapidly after 2000 did Kodak’s shrinkage begin in earnest, shedding jobs more quickly than the rest of the economy could absorb. From 2000 to 2010, Kodak employment fell 70%. And Kodak wasn’t alone. Xerox eliminated half the positions it had in 2000, and Bausch + Lomb dropped just over a third. Collectively, the community lost 25,000 jobs between the three.

But that statistic is a bit misleading. Included in Kodak employment in 2000 were business units Kodak sold or spun off. The largest were its remote sensing division—now part of ITT Geospatial—and its health group—now part of Carestream. Between them, these divisions probably employed about 3,000 in 2000 and locally still employ about 2,800 today.

Other manufacturing losses included the closure of Valeo’s plant—formerly GM’s Delco Products—which employed about 3,000 people in 2000. Birds Eye Foods was purchased by Pinnacle Foods and also closed. While only about 200 worked at the Rochester plant when it was shuttered at the end of 2010, Birds Eye employed nearly 800 in 2000. Other manufacturers cutting more than of fifth of their employment base over the decade were Seneca Foods (57%), IEC (52%), Gleason (40%), Garlock (33%), Pactiv (30%), and Hickey Freeman (21%).

The list of employment leaders changed over the decade, too. While the top 5 employers remained the same, their ranks changed, and the other firms in the top 10 in 2000 dropped out by the end of the decade.

Given these losses among our traditional employers, Rochester’s overall employment has held up remarkably well. The University of Rochester was the biggest gainer, adding nearly 5,000 jobs and moving into first place (although some of its growth is due to acquisitions). Paychex and Lifetime Healthcare Companies (Excellus) added 2,000 each. Between them, Verizon Wireless, Harris RF Communications, Sutherland Group, and Unity Health System added another 5,000 positions. While not in the Top 25, Paetec and HCR contributed another 1,100 jobs between them.

The firm-by-firm analysis reveals dynamism in the economy that is masked by macro-level statistics showing flat or slowly declining jobs. While individual losses have been great, more than a dozen large firms, many of them in the health care, education or communication sectors, added significant numbers of jobs over the decade.

Kent Gardner is president and chief economist of the Center for Governmental Research Inc.