There is nothing like the IRS Form 1040 and NYS Form 201 to get you in the mood for tax reform.

There is nothing like the IRS Form 1040 and NYS Form 201 to get you in the mood for tax reform.

We need a simpler system. Complexity is expensive by itself—we spend money simply keeping records and paying professionals to figure out what we can and can’t claim. The Taxpayer Advocate’s Service (TAS) of the National Taxpayer Advocate (appointed and funded by Congress) estimated in 2010 that taxpayers spend 6.1 billion hours filling out taxes each year (down from an estimated 7.6 billion hours in 2008, probably courtesy of tax software). 60% of Americans pay someone else to complete their tax forms. In 2008, TAS put the total cost of compliance at $163 billion, about 11% of total tax receipts.

The number and complexity of tax breaks opens the system to special interests—although my “special interest” may be your “critical need.” Fewer tax breaks would let us cut rates, simplify reporting and make the whole system more transparent. Both at the state and federal levels, our tax system looks like a Christmas tree that’s been decorated by 6 year olds—no order, and too many ornaments.

Take New York State. Thirty-four credits adorn the New York Personal Income Tax. All good things, of course—there’s the farmer’s property tax credit and the green building credit and the credit for purchasing an automated external defibrillator. We have a credit for volunteer firefighters, biofuel production, solar energy equipment purchases, and rehabbing historic homes. Some cost little—the green building credit cost us $400,000 in 2012. Some are sizeable: Child care and dependent care credits cost $341 million and the college tuition tax credit cost $287m. The Corporation Franchise Tax includes credits for historic barns, land conservation easements, security training, and film production (movies, not Kodachrome). Again, the cost varies. Security officer training cost about $300,000 while credits to the motion picture industry totaled about $340 million. The Sales Tax is a patchwork quilt. Food sold at senior citizen housing communities or through vending machines is exempt, as are pollution control equipment, machinery and equipment used in production, and food sold to airlines. What’s the problem? Tax preferences fly “under the radar,” making them easier to pass and harder to cut. Unlike budgeted expenditures, they are hard to measure and are typically open to all comers, thus are potentially unlimited.

Federal exemptions that affect state taxes are also numerous. The exclusion of capital gains on home sales is expected to cost NYS $1 billion in 2012. Capital gains on inherited property also escape taxation, costing NYS an estimated $1.1 billion. See NYS Tax & Finance’s report for more detail.

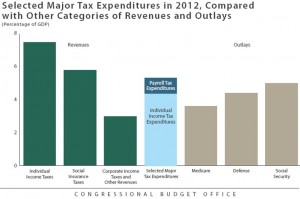

At the federal level, the size of the tax break problem is well documented. Called a “tax expenditure” by wonks, these are activities that are “financed” by agreeing to NOT collect a tax. The Congressional Budget Office regularly published an estimate of tax expenditures. A recent report showed that tax expenditures—those taxes we agree not to receive—cost us more than Medicare, Defense or Social Security. Eliminating tax expenditures would be nearly equivalent to doubling social insurance taxes.

Eliminating tax breaks is easier said than done. Certainly some are egregious and would likely disappear if put to a vote. Yet many—think of the mortgage interest deduction and the exclusion of capital gains from residential real estate—have a broad constituency. Probably most are well-intentioned. Some—consider the Earned Income Tax Credit—are a critical part of our social safety net.

The problem even has a local flavor—NYS industrial development agencies are often petitioned to confer tax breaks on local businesses, burdened by high cost and vigorous competition. If the business would leave without assistance, the net benefit is clear. Yet when the tax break goes to a firm with local competitors, the benefit to one may be offset by harm to another. The taxes of one may support a tax break to another.

In my rare utopian moments, I look for a leader who will broker a Grand Compromise that sweeps away myriad preferences, simplifies the tax system and puts our economy on a sound fiscal path. Unfortunately, the debate from now through the election will be reduced to a false choice between spending less or taxing more, between a Paul Ryan budget that many won’t support and a “Buffett Rule” with only symbolic impact.