The latest US Employment Report reminds us again of the “jobless recovery” phrase first used to refer to the recession of 1991. The report shows Private Non-Farm Payrolls in July grew by an anemic 71,000 jobs, falling short of consensus estimates. The unemployment rate remained unchanged at 9.5 percent, stable only because of the 181,000 people who left the workforce. Falling labor force participation rates indicate that a growing amount of people find the job market particularly unwelcoming. So we continue to play the waiting game—when, oh when, will the job market improve?

The latest US Employment Report reminds us again of the “jobless recovery” phrase first used to refer to the recession of 1991. The report shows Private Non-Farm Payrolls in July grew by an anemic 71,000 jobs, falling short of consensus estimates. The unemployment rate remained unchanged at 9.5 percent, stable only because of the 181,000 people who left the workforce. Falling labor force participation rates indicate that a growing amount of people find the job market particularly unwelcoming. So we continue to play the waiting game—when, oh when, will the job market improve?

Despite the dismal employment landscape, the economy has actually been growing over the past year. According to the federal Bureau of Economic Analysis real GDP increased at an annual rate of 2.4 percent last quarter. Corporate profits have doubled since bottoming out in fall of 2008, returning to pre-recession levels. And with such robust profits amidst a recovering economy, one would expect businesses to be increasing their capacity for moderate growth by expanding their workforce. But as the July employment numbers illustrate, this is hardly the case. So what are businesses doing with their income?

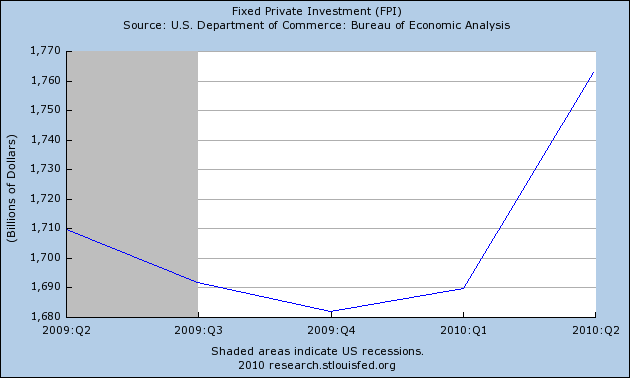

Instead of expanding payrolls, businesses are demonstrating a preference for taking advantage of low interest rates and extra cash to make capital improvements in anticipation of a future increase in demand, rather than hire, train, and pay new workers. This trend toward capital investment is evident in the surge of fixed private investment—up 17 percent—that bolstered GDP growth last quarter (see graph below).

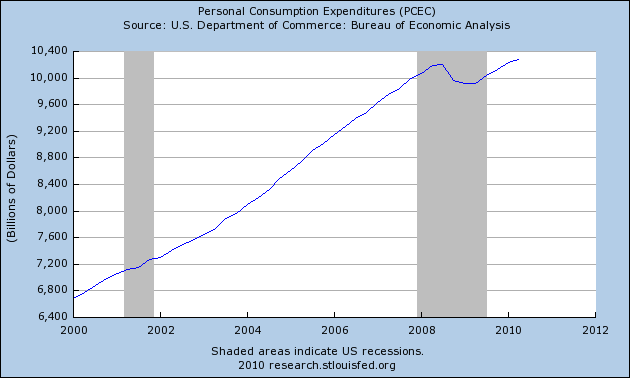

Now for the great challenge of our Great Recession recovery: personal consumption—the pillar of American demand—collapsed in 2008-09 for the first time since World War II (see graph below). This phenomenon is particularly concerning considering there have been ten other official US recessions in that period without such a decrease. As personal consumption makes up around 70 percent of expenditures, it will be nearly impossible to foster and maintain any significant demand growth without consumers playing a large part. So what are consumers doing with their income?

Consumers are doing the rational thing by exercising fiscal discipline and engaging in responsible financial planning. Personal savings rates were at zero or below as consumers gorged on credit in an economy awash in liquidity. As a vast amount of home equity evaporated in the financial crisis, consumers are cutting back in an attempt to get their personal balance sheets back in order. Long-term economic growth and stability can only be achieved if consumers are once again in a position to spend money.

So corporations are shouldering the brunt of the economic recovery, for now. They are also reaping the benefits as bond ratings climb and interest rates on corporate debt hit new lows—IBM auctioned $1.5 billion at 1 percent on Friday. But Big-Blue’s low borrowing cost may also be a reflection of preference for the perceived safety of well-performing American companies—a rational tendency in light of recent instability, such as the foreign sovereign debt crisis—and less of an overall endorsement of the recovery.

Eric Morris, M.A. is a Research Assistant at the Center for Governmental Research (CGR) in Rochester, NY.