At long last, we’ve been treated to a streak of positive news on the U.S. economy. Job growth continues, with 227,000 added in February and 900,000 over the past five months; the application rate for jobless benefits now stands at a four-year low; and the unemployment rate has fallen from 9.0 to 8.3 in a year. And while the sharp decline in the unemployment rate appears to have slowed in the past three months, there’s even a silver lining there as more people resumed their search for work in the face of a better employment outlook (about 500,000 in February). It’s tough to argue that’s anything but good news.

At long last, we’ve been treated to a streak of positive news on the U.S. economy. Job growth continues, with 227,000 added in February and 900,000 over the past five months; the application rate for jobless benefits now stands at a four-year low; and the unemployment rate has fallen from 9.0 to 8.3 in a year. And while the sharp decline in the unemployment rate appears to have slowed in the past three months, there’s even a silver lining there as more people resumed their search for work in the face of a better employment outlook (about 500,000 in February). It’s tough to argue that’s anything but good news.

But it’s a different story in the nation’s public sector, where near-term prospects are not nearly as sanguine. Especially at the state and local levels, government is belatedly cutting back after being insulated from job cuts through federal stimulus money (financed by debt) and a depletion of fund balance. Also, economic growth in the private sector remains slow and has yet to replenish public coffers. Consider the following:

- The Census Bureau and Rockefeller Institute both noted last week a softening in state and local government revenues. While tax collections have continued to rebound from the recession’s depths, the growth rate for personal income and sales taxes has slowed and corporate income taxes actually fell slightly. Although the revenue estimates are based on incomplete data (we won’t know what truly happened in 2011 until summer), the trend is troubling.

- A Center on Budget and Policy Priorities report issued last week documented the profound financial challenges facing state governments. For fiscal 2013, it notes, thirty states are facing budgetary shortfalls totaling $49 billion. “The Great Recession…caused the largest collapse in state revenues on record,” the report points out. “As of the third quarter of 2011, state revenues remained 7 percent below pre-recession levels, and are not growing fast enough to recover fully soon.”

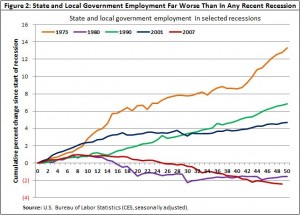

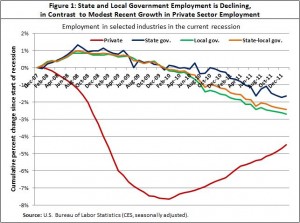

- And a Rockefeller Institute report last month showed a continuing decline in state and lo

cal government jobs in a majority of states. “Private employment fell more sharply than government employment during and immediately after the recession,” the report notes. But although the decline in public employment lagged the private sector, “the depth of such decline has surpassed losses associated with any other modern recession.”

cal government jobs in a majority of states. “Private employment fell more sharply than government employment during and immediately after the recession,” the report notes. But although the decline in public employment lagged the private sector, “the depth of such decline has surpassed losses associated with any other modern recession.”

As last month’s Rockefeller report makes clear, it’s normal for the public sector to be insulated from the early  and most acute impacts of recessions. In fact, during the recessions of 1973, 1990 and 2001, “public employment continued to increase while private sector jobs were declining.” As private employment has recovered, public employment has begun a delayed slide. Over the past year, state and local government employment was down in 33 states; private employment was up in all but two. Nationally, private employment grew 1.6 percent from Q3 2010 to Q3 2011; government employment was the mirror opposite, falling 1.6 percent.

and most acute impacts of recessions. In fact, during the recessions of 1973, 1990 and 2001, “public employment continued to increase while private sector jobs were declining.” As private employment has recovered, public employment has begun a delayed slide. Over the past year, state and local government employment was down in 33 states; private employment was up in all but two. Nationally, private employment grew 1.6 percent from Q3 2010 to Q3 2011; government employment was the mirror opposite, falling 1.6 percent.

The public sector’s relative insulation from the Great Recession’s early effects was, of course, aided by federal stimulus dollars. But while that two-year funding helped alleviate some of the short term pain, it served to kick the can down the road on many of the larger structural issues facing state and local governments. Reinforcing the challenge is the ripple effect created as state governments had their fiscal integrity compromised and either stopped increasing (or worse yet, decreased) aid to local governments and school districts. The resulting fiscal situation is at crisis levels in many communities.

There’s a direct connection between the public sector’s ability to raise revenues (via property, income, sales or other taxes) and the health of the larger economy. The Great Recession was a three-headed monster for government finance, as property taxes were compromised by weakened valuations; income taxes were impacted by the unemployment spike; and sales taxes were done in by fiscal prudence on the part of consumers who curbed spending in the midst of economic uncertainty.

So while the larger economy appears to be gaining steam as consumers slowly emerge from their hibernation, the state and local government sector is firmly on the ropes. The national employment rebound isn’t likely to proceed fast enough to stabilize government budgets in the near term. States and localities must make fundamentally difficult decisions about their services and costs. The decisions they make have the potential to significantly change the way they do business.

Citation for both graphs: “State & Local Government Jobs Continue to Decline in Most States,” Rockefeller Institute of Government, February 2012