Governor Cuomo has been widely criticized for the modest achievements of the “Start-Up NY” economic development program. In a report released on Friday of the July 4 weekend (timing that raised eyebrows), the state attributed only 332 jobs to the program during 2015, thus a total of 408 jobs since the program’s inception.

Governor Cuomo has been widely criticized for the modest achievements of the “Start-Up NY” economic development program. In a report released on Friday of the July 4 weekend (timing that raised eyebrows), the state attributed only 332 jobs to the program during 2015, thus a total of 408 jobs since the program’s inception.

If you’re not familiar with the program, here’s a quick summary: Firms can qualify for an exemption from most taxation—sales, property, even personal income taxes owed by individuals hired to work in the venture. And the benefits last up to 10 years. It’s a sweet deal if you qualify.

Why so few jobs? First, there’s the “if you qualify” caveat. Firms have to be certified as new to NYS or expanding within the state. The venture must to be developed in partnership with a participating college or university. The list of eligible industries is limited. Burned by the indiscriminate application of the Empire Zones program (see a scathing review from the Citizens Budget Commission), the Cuomo administration has established a complex approval process intended to prevent cheating. Of course, even simple approvals take forever in NYS. I’m also told that Empire State Development, like many state agencies, is short staffed. Governor Cuomo has kept his pledge to reduce state payrolls, a laudable achievement. Program administration may have suffered, scaring away prospective applicants.

Economic success is far less predictable than we like to believe. Narrow eligibility criteria amount to picking winners and losers. A more effective long term strategy is the creation of a level and inviting playing field.

I suspect that the problem with Start-Up NY is more fundamental. Perhaps the “logic model” is flawed, that New York’s lackluster economic performance has a more complex cause than high taxes. Let’s think of Start-Up NY as an experiment. If our economy would boom simply by cutting taxes, then a program that nearly eliminates taxes for a decade should have no end of applicants. I’d be the last to suggest that taxes don’t matter to business attraction and retention. But if taxation were the whole enchilada, then NYC would dry up and fly away and Alabama—with the lowest state and local tax collections per capita in the nation—would be our foremost economic engine.

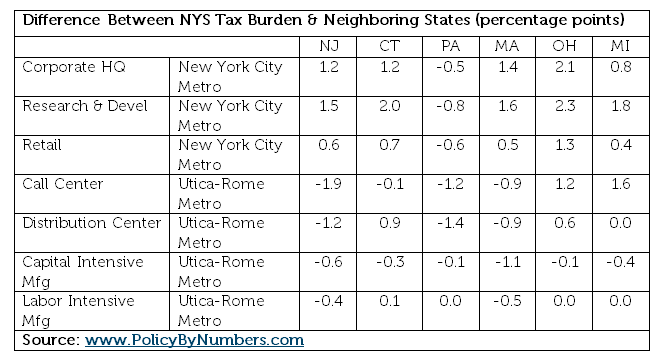

The evidence suggests that taxes are only a “tipping factor” in location decisions. A friend of mine, John Bacheller, just published a pertinent table in his blog. Executive Deputy Commissioner of Empire State Development before he retired, John knows a thing or two about incentives. He estimated the differential, as a share of business operating expense, between New York taxes and median tax rates for the nation. New York taxes are generally higher—but for no sector was the difference more than percentage points. And John reports that NYS taxes are actually lower in some sectors Upstate, although the advantage is still under two percentage points. He published comparisons by sector with neighboring states, too. See below.

It isn’t that NYS taxes are low—the Tax Foundation estimates that New York’s state and local tax burden, measured as a share of state income, was the highest in the nation in 2012 (almost 13%), although barely higher than New Jersey and Connecticut. But this is a complicated story—New York’s corporate tax rank (again from the Tax Foundation) was actually a bit better than the average, ranked at #23.

John’s point—and mine—is that taxes are a small part of the cost of doing business, even in New York. Labor cost looms large for nearly every business venture. That’s why decisions about the minimum wage, paid family leave, and other labor regulations are consequential. Nor are these the whole story. The true cost of labor, for example, is determined by wages AND productivity. If New York’s high school graduates fall short of world standards, our economy will suffer, too. If we think of our economy as a product – build it and they will come – then the focus should be on workforce development, raising educational outcomes and retaining a talented labor pool.

John’s point—and mine—is that taxes are a small part of the cost of doing business, even in New York. Labor cost looms large for nearly every business venture. That’s why decisions about the minimum wage, paid family leave, and other labor regulations are consequential. Nor are these the whole story. The true cost of labor, for example, is determined by wages AND productivity. If New York’s high school graduates fall short of world standards, our economy will suffer, too. If we think of our economy as a product – build it and they will come – then the focus should be on workforce development, raising educational outcomes and retaining a talented labor pool.

Business tax incentives may be a necessary part of the state’s economic development toolkit, although I’d argue that the specificity of film production credits, tax breaks for video game producers and niche programs like Start-Up NY should give way to concerted efforts to remove nuisance taxes, unnecessary regulatory hurdles and to speed regulatory review.

Business tax incentives may be a necessary part of the state’s economic development toolkit, although I’d argue that the specificity of film production credits, tax breaks for video game producers and niche programs like Start-Up NY should give way to concerted efforts to remove nuisance taxes, unnecessary regulatory hurdles and to speed regulatory review.

The disappointing response to Start-Up NY should remind us that economic development is difficult work. Let’s build the human and physical infrastructure that will entice out-of-state firms to do business in New York, support the growth of established firms, and enhance the capacity of residents to form new ventures here at home.