Given a conflict between “good for us” or “good for me,” people generally pick the second. That proposition, obvious as it is, underlies most of economics. Thank goodness, human beings often rise above self-interest in ways that redeem human society.

Given a conflict between “good for us” or “good for me,” people generally pick the second. That proposition, obvious as it is, underlies most of economics. Thank goodness, human beings often rise above self-interest in ways that redeem human society.

But politicians shouldn’t push their luck. Consider what the European Union is asking of the Greeks. The austerity imposed as a condition of the bailout goes beyond expecting Greeks to behave like Germans, which would be heroic enough. No, the Greeks are expected to do penance for their past profligacy, the “sackcloth and ashes” Full Monty.

Kidding ourselves

Reluctant to think ourselves selfish, we have a remarkable capacity to convince ourselves that “good for me” is also “good for us.” That capacity for self-delusion is evident in results from the Pew Global Survey: Respondents in Britain, France, Germany, Greece, Spain, Italy, Poland and the Czech Republic were asked to identify the “hardest working” people of Europe. Seven picked the Germans. The Greeks picked themselves. For the title, “least hardworking,” five picked the Greeks, but the Greeks fingered the Italians.

Is it any wonder that the Greeks’ penance is insincere? Or that support for austerity among voters proved to be so tenuous in Sunday’s election?

That invisible hand

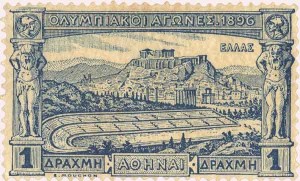

If Greece still used the drachma (instead of the euro), global markets would impose austerity impersonally—not only would the hand be invisible, but the fingerprints would be smudged. Here’s how it works. A nation spends money it doesn’t have, as Greece has done habitually. To make up the difference, it borrows on global markets or prints more money. As a consequence, the exchange rate falls.

If Greece still used the drachma (instead of the euro), global markets would impose austerity impersonally—not only would the hand be invisible, but the fingerprints would be smudged. Here’s how it works. A nation spends money it doesn’t have, as Greece has done habitually. To make up the difference, it borrows on global markets or prints more money. As a consequence, the exchange rate falls.

Remember that a country’s exchange rate is an expression of confidence in the future value of its currency. Excessive borrowing erodes that confidence. And printing money has an even more direct impact on the exchange rate—if the supply of anything rises without a change in demand, the price falls.

The falling exchange rate reduces the value of the nation’s labor and goods, forcing its people to work harder to earn the same amount of foreign stuff—cars, corn, cameras. Voila! Austerity without an election. Sure, lots of people know who is responsible, more or less. But the fingerprints are smudged and everyone has an alibi.

Inside the euro zone

Countries in the euro zone gain the stability of group membership but lose the exchange rate as an instrument of policy. When they get into trouble, the only choices are to spend less, tax more, or borrow. First they try borrowing—but if investors fear default, they’ll ask for higher and higher interest rates, making the fiscal situation worse.

Enter the bailout: Strong euro zone members back loans to weak ones as the alternative—default—would hurt even more. But they extract austerity measures (spending less, taxing more) in exchange.

Which brings us back to the willingness of voters to embrace sacrifice: We can rise above our own self-interest, but we must be inspired to do so.

Are we different?

Cultural and social mores empower us to vote against our personal interest. The New York Times’ David Brooks recently wrote of our increasing tolerance for debt. He speculates that people of previous generations lived with much greater insecurity. My mother’s generation, raised in the Great Depression, learned a deep-seated aversion to debt that has served us well. But no longer. We max out our credit cards, assume massive amounts of debt for college, and take out mortgages we cannot afford. Our willingness to go into debt was one of the (many) triggers of the Great Recession.

Brooks argues persuasively that voters are unwilling to embrace the hard truths of scarcity. The Greeks want to believe that life can go on as before without painful cuts in spending or increased taxes. Americans eagerly embrace tax reduction, but are unwilling to ask less of government.

Democracy may be better than the alternatives, but it is an imperfect tool. We must look to inspired leaders, our educational system, and social and cultural institutions to help us see beyond our own narrow interests.

Greece defers crisis

The rebirth of the drachma may still come, although, in Sunday’s voting, Greek voters narrowly supported what The Economist dubbed “chronic misery” over “acute disaster.” The margin was narrow—the party supporting austerity (the chronic misery option) won only 30% of the votes. Its principal opponent (whose desire to abandon the euro would likely precipitate acute disaster) won 27%. The New Democracy party just formed a government. But it is a perilously weak coalition of uneasy bedfellows. Its ability to act boldly to reform the Greek economy will be quite limited.

Britain: “I Told You So . . .”

Under PM Margaret Thatcher, the British chose to retain the pound, declining an invitation to join the euro. Perhaps they can be excused a little triumphalism, as circumstances have confirmed the wisdom of that decision, at least for Britain. As the likelihood of an immediate euro withdrawal by Greece recedes, markets have turned their attention to Spain, driving up the Spaniards’ cost of borrowing. From the perspective of investors, the Spanish bailout seems too late and too small. Nigel Farage, a British member of the European Parliament, notes in this video clip the absurdity of weak Euro Zone members being forced to add to their indebtedness at a high interest rate to lend to Spain at a lower one. The euro may weather this crisis intact, but currency unions without political union cannot last forever.

Under PM Margaret Thatcher, the British chose to retain the pound, declining an invitation to join the euro. Perhaps they can be excused a little triumphalism, as circumstances have confirmed the wisdom of that decision, at least for Britain. As the likelihood of an immediate euro withdrawal by Greece recedes, markets have turned their attention to Spain, driving up the Spaniards’ cost of borrowing. From the perspective of investors, the Spanish bailout seems too late and too small. Nigel Farage, a British member of the European Parliament, notes in this video clip the absurdity of weak Euro Zone members being forced to add to their indebtedness at a high interest rate to lend to Spain at a lower one. The euro may weather this crisis intact, but currency unions without political union cannot last forever.