Despite issues weighing down the US economy –fiscal stress in Europe, continued high unemployment, and gridlock over federal fiscal policy – the Rochester, NY economy is a bit of a success story. As summarized in a recent Wall Street Journal article, Rochester, “ticks many of the standard Rust Belt boxes” yet has held relatively steady through the recession.

Despite issues weighing down the US economy –fiscal stress in Europe, continued high unemployment, and gridlock over federal fiscal policy – the Rochester, NY economy is a bit of a success story. As summarized in a recent Wall Street Journal article, Rochester, “ticks many of the standard Rust Belt boxes” yet has held relatively steady through the recession.

As a participant in the Rochester Downtown Rotary’s annual economic forecast luncheon, I was pleasantly surprised by the generally upbeat expectations of my fellow panelists. Moderated by Sandy Parker, head of the Rochester Business Alliance, it included Steve Babbitt, chairman of the board of the Greater Rochester Association of Realtors; Brad McAreavy, president of the Rochester Auto Dealers’ Association; and Clayton Millard, first vice president of wealth management at Merrill Lynch.

While realtors are congenitally optimistic, Steve Babbitt’s positive outlook for the housing market is supported by two recent national releases. Homes.org, an online source of listed homes nationwide, identified promising markets using affordability, appreciation potential, price stability, area unemployment/job potential, and median price. Rochester was one of its top nine metros, along with Washington, DC, Santa Fe, NM, Bremerton, WA, Orlando, FL, Austin, TX, Houston, TX, Cambridge, MA, and Chicago (see http://t.co/NOzNINNA).

Jed Kolko, Chief Economist at Trulia, another website devoted to real estate issues, posted his “top cities” in a Huffington Post column. He also included Rochester, along with Austin, Houston and Cambridge. He added San Jose, CA to homes.org’s list. As it happens, Kolko hails from Brighton, a Rochester suburb. He had to assure his readers that he’d not “put his thumb on the scale” and was frankly surprised that Rochester scored so well, given Kodak’s well-publicized troubles (see http://t.co/fCd5qjx6).

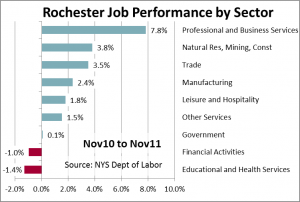

I find the breadth of recent employment growth encouraging. We’re accustomed to seeing education and health care driving most of the region’s growth. Yet in 2011, this sector actually shrank. And manufacturing, long the source of job losses, added an estimated 1,400 positions. Growth spread across the economy is more likely to persist.

As the Wall Street Journal highlighted on Dec. 24, the recent economic downturn gave rise to a partial rebirth of Rochester’s entrepreneurial past: “Many of the people laid off by the large companies in Rochester are highly trained engineers who have started their own companies and live in the upscale neighborhoods of Pittsford, Penfield and Brighton,” the piece explained. “Some have left the engineering world behind as they made the transition from company man to entrepreneur.”

While the panelists are all feeling good about the future, we also agree that the downside risk is greater than the upside risk. Clayton put it best: A continued lackluster recovery is the most likely good outcome. At the other extreme, a collapse of the Euro is not beyond the realm of possibility. And that would be very disruptive to the world economy.

I’m not optimistic that the Europeans will do better than muddle through the ongoing Euro crisis. In aggregate, the Europeans will be looking to refinance about $200 billion in debt during the first quarter, one third of that by Italy. As Italian debt yielded 7% at the end of the year, refinancing will be an expensive proposition and will make the country’s fiscal challenge that much greater.

Domestically, the national election will encourage Congress and the President to delay bold action, as each side seems to fear handing a “win” to the other, even if that success can be shared. Deals like the unsatisfactory compromise on the payroll tax extension may be all we can expect.

The collective positive tone on the panel follows cautious optimism expressed by economists at the national level heading into 2012. Some of the factors behind Rochester’s success story – job creation, investment by businesses small and large, and a healthy housing market – may help to drive such comebacks in other metros.

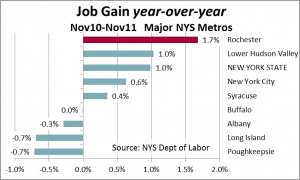

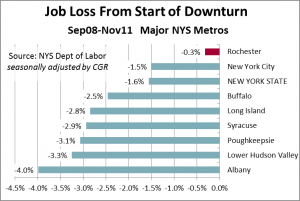

See below for updated charts on Rochester’s comparative performance, discussed in Policy Wonk on November 14 (see http://bit.ly/zVMTSF).