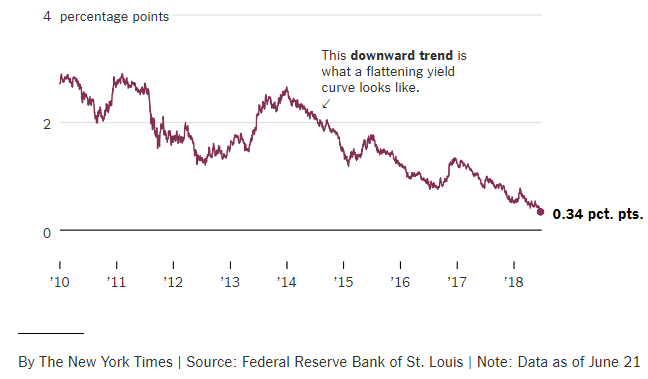

The yield curve compares interest rates charged on long term and short term bonds—typically, 10 year v. 2 year U.S. Government treasuries. When the 10 year rate is lower than the 2 year rate, the yield curve is said to be “inverted” and may be “predicting” a recession.

The yield curve compares interest rates charged on long term and short term bonds—typically, 10 year v. 2 year U.S. Government treasuries. When the 10 year rate is lower than the 2 year rate, the yield curve is said to be “inverted” and may be “predicting” a recession.

The yield curve is nothing but a sophisticated investor confidence survey—if investors expect inflation will rise, then they will demand a higher yield (or interest rate) for longer maturity bonds.

Some of you may remember the TV series, Early Edition. Every morning the protagonist found tomorrow’s newspaper outside his door. Blessed (or cursed) by knowledge of the future, he spent the rest of the episode trying to fix things.

Suppose you found the Wall Street Journal from 2028 on your doorstep or in your email’s inbox and learned that inflation, 2% today, had risen steadily to 5%. To compensate for the loss in inflation-adjusted yield (the interest rate minus inflation), you would demand a higher interest rate for bonds with longer maturities.

On the flip side, if your “early edition” of the WSJ showed inflation to have stayed the same or fallen, you’d be willing to accept a lower yield (rate of interest). Read more »