Health care is different from other goods and services.

Health care is different from other goods and services.

- As a wealthy society, we aren’t willing to limit access to care based on ability to pay (at least entirely).

- Caveat emptor—let the buyer beware—fails in the face of complexity: The patient (the “buyer”) is often incapable of understanding what is appropriate or necessary and must rely on the provider (the “seller”) for essential advice.

- The pace of technological change outstrips our capacity to set limits on what constitutes adequate care.

- Public policy, operating through payment schema and regulation, is a blunt instrument, influencing the marketplace in both intended and unintended ways.

These factors create irreconcilable challenges for the health care system: Cost control is in conflict with improved access to care. Restrictions on technology hinder innovation. Public sector pricing pushes cost onto private payers. Empowered consumers can erode the authority of health care professionals and increase the use of unproven therapies.

These factors create irreconcilable challenges for the health care system: Cost control is in conflict with improved access to care. Restrictions on technology hinder innovation. Public sector pricing pushes cost onto private payers. Empowered consumers can erode the authority of health care professionals and increase the use of unproven therapies.

The role of the public sector

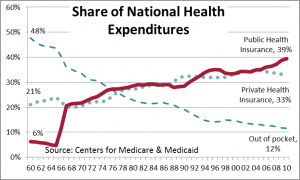

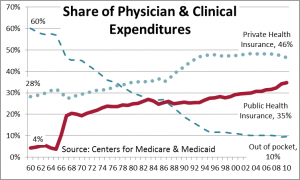

The most important change in the health care sector in the last 40 years has been the shift in who pays. Nearly half of all health care was paid for by patients in 1960. By contrast, the public insurance share expanded steadily from 6% to 39% by 2010. Over half of hospital expenditures now come through public insurance. Thirty-five percent of  physician and clinical expenses flowed through government in 2010. Medicare and Medicaid, both started in 1966, now account for 36% of all health care spending.

physician and clinical expenses flowed through government in 2010. Medicare and Medicaid, both started in 1966, now account for 36% of all health care spending.

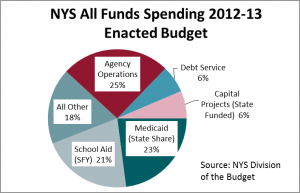

Health care is a much bigger target when the public purse is empty: Medicaid, Medicare, and the Child Health Insurance Program (CHIP) are 21% of the federal budget. Medicaid is 13% of state budgets overall and 23% of New York State’s, which spends nearly as much on Medicaid as it does on state agency operations. In NYS, counties are also part of the Medicaid funding and oversight picture.

The public sector plays more—and more conflicting—roles in the health care sector than in any other part of the economy. As payer, it attempts to promote efficiency and to cut  spending. As regulator, it establishes standards and enforcement procedures, and the recordkeeping that follows. As defender of the disadvantaged, it promotes access to products and services. These roles are shared across levels of government, and across units of government within the same level. As important as all of these roles are, they create irreconcilable conflicts.

spending. As regulator, it establishes standards and enforcement procedures, and the recordkeeping that follows. As defender of the disadvantaged, it promotes access to products and services. These roles are shared across levels of government, and across units of government within the same level. As important as all of these roles are, they create irreconcilable conflicts.

Aligning incentives: The role of policy

Health care policy is about managing the conflicting interests of regulators, payers, consumers and providers. “Innovations” in health insurance—from HMO gatekeepers and holdbacks to consumer directed health plans (CDHP) to “episode of care” payment schemes—aim at aligning incentives with desired outcomes.

The insured consumer is insulated from price signals. Co-payments and deductibles align health care consumers’ incentives with those of the payer. The irreconcilable challenge is that discouraging overuse will also discourage appropriate use: Some consumers, some of the time, will avoid getting timely and appropriate care. Yet the knowledge gap between the consumer (the patient) and the supplier (the physician) is troublesome. A consumer brings much more knowledge to a purchase decision about, say, food or clothing, than he or she brings to decisions about medical care.

A fee-for-service model creates a cost-boosting incentive for providers. Pre-approval, rigid practice guidelines and other incentives are designed to address this problem. The irreconcilable conflict is that rigid rules and guidelines will be objectively wrong part of the time.

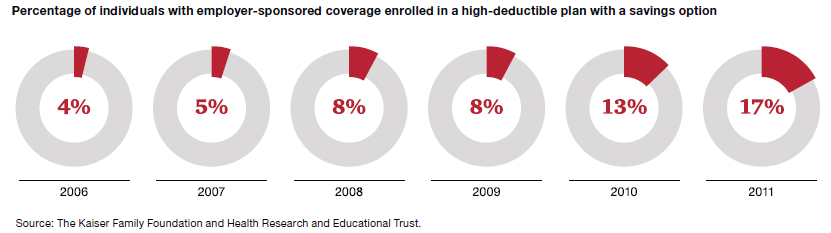

Consumer-directed health plans—combining high deductibles with dedicated savings accounts—do appear to save money. The “price” we pay in delayed or avoided care is probably unmeasurable; even if we knew, opinions would differ on whether the tradeoff was appropriate. In this model, Polly Patient pays “first dollar” for her care, forcing her to think twice about getting care and to ask about prices: “So, Doc. How much is this going to hurt (my pocketbook)?” With traditional insurance plans, prices are hidden—we don’t know that the same procedure can cost twice as much in one setting as another or that a 90-day supply of a drug costs only slightly more than a 30-day supply. (See http://blog.cgr.org/kent-gardner/making-sense-of-health-savings-accounts-2/ for a longer discussion of CDHPs.)

The shift to CDHPs has been rapid: 17% of individuals with employer-sponsored coverage are in some form of high deductible plan, twice the rate in 2009. Many attribute recent moderation in health care cost inflation to increased use of high deductible plans, although weakness in the economy surely contributed. The IMS Institute for Healthcare Informatics reports that doctor office visits fell 4.2% in 2010 and 4.7% in 2011.[*] A corresponding increase in the use of standalone retail clinics may be a factor. A PwC survey of consumers found that over 23% of consumers patronized a retail clinic in 2011 compared to

about 10% in 2007.

But not in New York State. A 2011 Manhattan Institute study found fewer than 20 physician-owned clinics operating in retail stores in NYS, placing New York among the four states with the lowest utilization of retail clinics.[†] Limitations on the independent practice of nurse practitioners and other mid-level medical professionals plus onerous certificate-of-need provisions are cited by the author as factors limiting expansion in NYS.

Loss of patent protection for important drugs may also have played a role in recent cost moderation: PwC Health Research Institute found that a significant group of branded drugs came off patent in 2011, representing sales of $28 billion; another $26 billion will follow this year.

Federal policy: Balancing cost & coverage

The main thrust of President Obama’s Affordable Care Act was the expansion of health care coverage. The law will increase the share of GDP spent on health care, that’s certain. The Congressional Budget Office (CBO) found the law will not increase the deficit—but that’s because ACA increases revenue. The CBO estimates that the gross cost of ACA from 2012-22 will be $1.8 trillion (http://goo.gl/oFZW5).

The future cost of health care is artificially reduced by the assumption that a statutory reduction in Medicare payment rates will actually go forward, though Congress never allows that to happen. Part of the “sustainable growth factor” model passed years ago, this Kabuki drama over Medicare rate reductions is popular in Congress, they keep bringing the cast back for encores. Currently a 31% physician rate reduction is looming on January 1. As noted in a CMS memorandum, “[T]he scheduled physician payment reduction is implausible . . . It is reasonable to expect that Congress would find it necessary to legislatively override or otherwise modify the reductions in the future.[‡]”

Cutting cost & improving care must go together

The “sustainable growth factor” approach to cost reduction is typical of the crude, often naïve approach to cost reduction adopted by government. If cost=units of service X price—and there are more voting consumers than voting suppliers—then the temptation to cut price is hard to resist. Fortunately, there are better models.

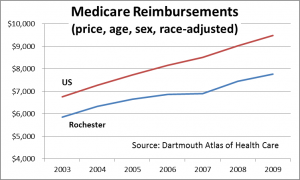

The Dartmouth Atlas of Health Care reports that the total cost per Medicare recipient in the Rochester Hospital Referral Region (HRR) was nearly 20% lower than the nation (when adjusted for local prices, age, sex and race). The Milliman consultancy reported that for 2007, commercial insurance cost per member per month in Rochester was almost ¼ lower than the nation.

The Dartmouth Atlas of Health Care reports that the total cost per Medicare recipient in the Rochester Hospital Referral Region (HRR) was nearly 20% lower than the nation (when adjusted for local prices, age, sex and race). The Milliman consultancy reported that for 2007, commercial insurance cost per member per month in Rochester was almost ¼ lower than the nation.

Dartmouth’s analysis indicates that Medicare spending on physicians is much lower in Rochester, 74% of the national average. For the non-elderly addressed by the Milliman study, the lowest cost category is inpatient hospital care—63% of the comparable cost for the nation.

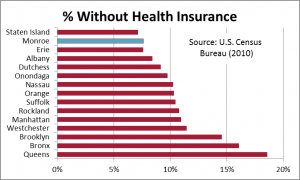

Lower cost=higher coverage? Of New York’s largest 15 counties, only Staten Island has a lower uninsured rate than Monroe County.

Lower cost=higher coverage? Of New York’s largest 15 counties, only Staten Island has a lower uninsured rate than Monroe County.

The Institute of Medicine just released a report supporting the notion that smarter health care can be cheaper—and better. IOM reports that one-fifth of patients responding to a survey reported that medical test results or records weren’t transferred in time for a related appointment. One-quarter said that physicians had a re-order test to confirm a diagnosis. In aggregate, IOM reports that about one-third of health care spending is wasted.[§] By finally forcing the (painful!) implementation of electronic medical records, ACA may create a foundation for more effective care, not just broad cuts in provider reimbursement.

We may be ahead of the curve here in Rochester. The Rochester Medical Home Initiative, a trial approach to primary care administered by Excellus and MVP, proved that vigilant primary care can reduce overall system cost. Participating doctors reduced unnecessary hospital admissions, cut re-admissions and reduced use of hospital emergency departments. This trial that will be dramatically expanded under the $26.5 million awarded to the Finger Lakes Health Systems Agency by the Federal Center for Medicare & Medicaid Innovation grant program. The grant provides the more comprehensive primary-care model to patients at high risk for hospitalizations and emergency-room visits. And in the works is the Finger Lakes Regional Clinical Quality Improvement Initiative, a consortium of all of Rochester’s major health care players, intended to identify what works, what doesn’t, and to disseminate this information to physicians throughout the region.

Yes, the Affordable Care Act will improve access to health care—but that will lead to higher cost unless we reduce spending per patient. Better care management that leads to lower cost is critically important. Given the public sector’s role in health care, the alternative to more effective care will be some combination of less care and lower prices to providers. No nation can afford to spend half or more of its income on health care—which is where the current trendline will take us. Herbert Stein famously said, “If something can’t go on forever, it will end.” Thanks for the advice, Herb.

Published in the Journal of the Monroe County (NY) Medical Society, fall 2012

[*] http://pwchealth.com/cgi-local/hregister.cgi/reg/medical-cost-trend-behind-the-numbers-2013.pdf

[†] http://www.manhattan-institute.org/pdf/mpr_12.pdf

[‡] http://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/ReportsTrustFunds/Downloads/2012TRAlternativeScenario.pdf

[§] http://www.iom.edu/Reports/2012/Best-Care-at-Lower-Cost-The-Path-to-Continuously-Learning-Health-Care-in-America.aspx